Attendees will learn:

- Entity Choices That Matter — Sole Prop, LLC, or S-Corp? We’ll walk through what’s best for different stages of business growth.

- Tax Strategy Beyond April 15th — quarterly payments, smart deductions, and year-round planning so you’re never caught off guard.

- Separating Business & Personal — the systems that keep your books clean, your stress low, and your money safe.

- Money Mapping for Growth — how to budget intentionally, track revenue streams, and recognize when it’s time to scale or hire.

- Profit with Purpose — how to make financial decisions that align with your vision, protect your peace and let you pay yourself like the CEO you are.

Other Important Details for Attendees:

- This session will be interactive — come ready with your questions about taxes, business strategy, or financial growth.

- You’ll get access to a free recap resource highlighting the key takeaways from the training.

- Beyond the session, you’ll also be invited into the Profit Therapy Community — our dedicated space where therapists and entrepreneurs get ongoing support with weekly

- Achievement Academy calls, curated resources, and a network of peers who understand the journey.

- The goal: you’ll leave with clear next steps, real tools you can use right away, and a community that keeps you accountable long after the session is over.

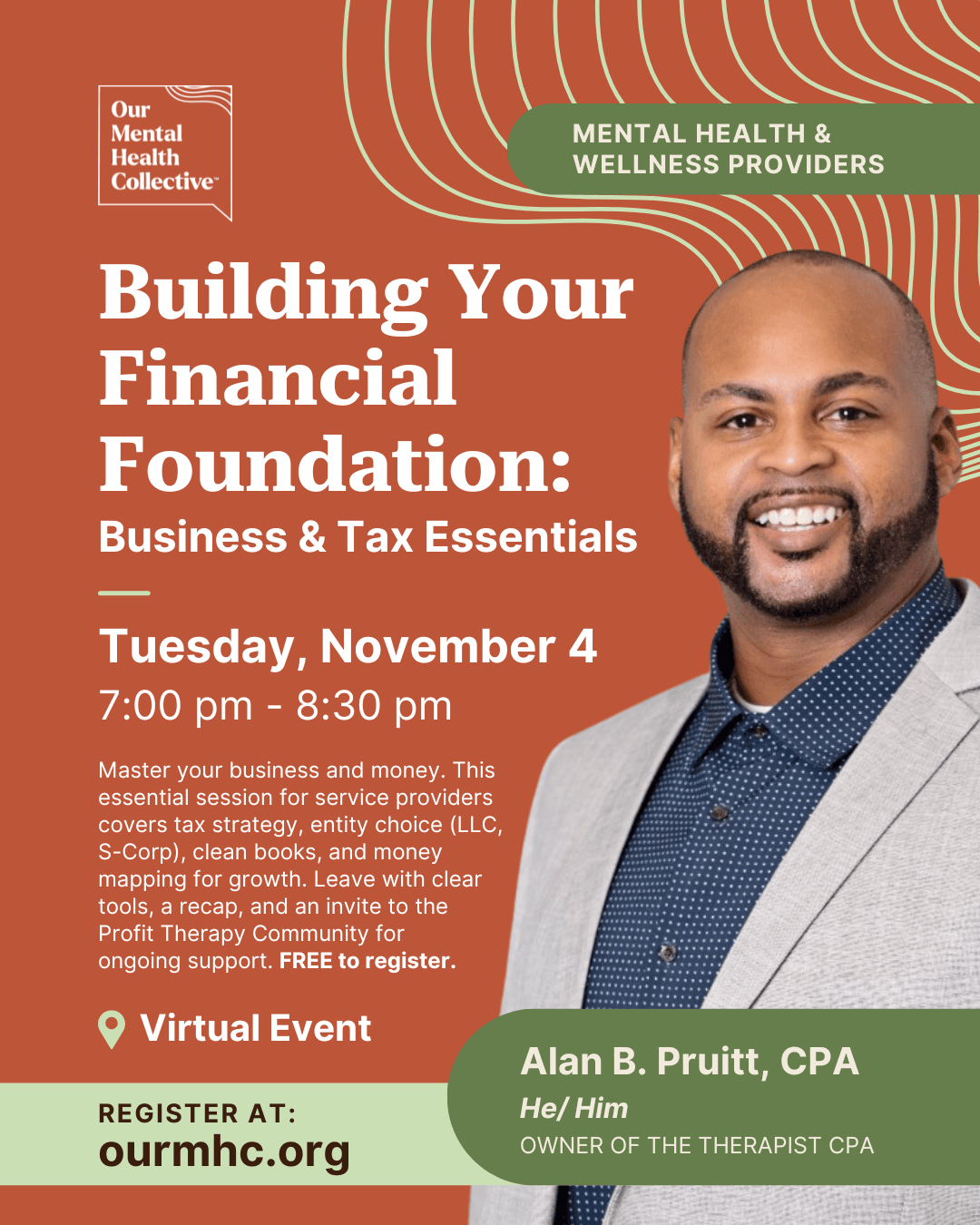

Tuesday, November 4, 2025

7:00 pm – 8:30 pm